For the month of August, I am going to try out the 1 Paycheck Challenge to save money.

Basically, it’s what it sounds like. Since I get paid twice a month, I am going to attempt to pay all of my bills with just one of my paychecks, and save or invest the other paycheck.

Give it a try, even if just for the sake of crunching some numbers. You might be surprised with how much money you could be putting into your savings account without much thought!

This is my first official Challenge on this blog (I love Challenges, so I’ll be sharing a lot of them with you!), and also the first post dedicated to the Money Stuff.

You can follow my journey on Twitter @nishimurahiroko!

Can’t Commit to 1 Paycheck a Month?

Many of us have a lot of bills, student debts, credit card debts, etc. that would prevent us from budgeting on just 1 paycheck, which makes saving money a challenge. That was definitely me until recently, when I switched my job. Even if that’s the case, I think there is a lot of benefit to taking a look at your numbers, crunch them a bit, and seeing what you might be able to commit to saving for the month of August.

I also recommend the $20/week Challenge, where you cash out or deposit into your savings account $20 every week. If easier, you can deposit $10 twice, or $5 four times. This will finish you off after a year with $1040 in your savings account! Even between this week and the end of 2017, we still have 22 weeks left, which would put you at $440 extra in your savings account. Trying to save money doesn’t have to be about struggles. Even that’s a pretty nice cushion for a rainy day!

Step 1: What’s My Net Pay?

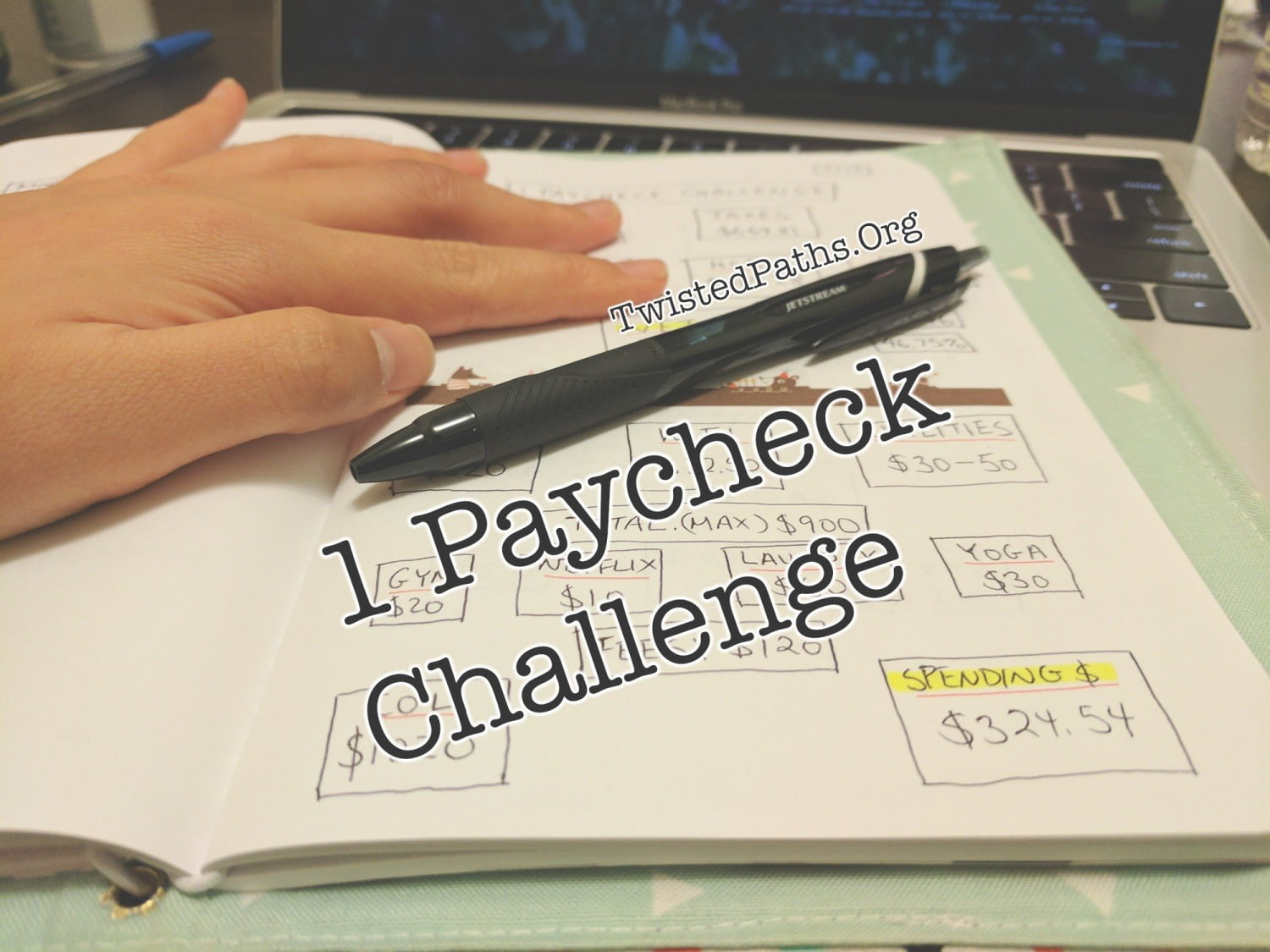

First step to saving money was to figure out how much of my paycheck I was actually taking home. For some number crunching, I busted out my handy dandy Fauxdori planner/notebook. From my ADP Account Summary (Online Pay Stubs), I knew that I had a few things being taken out of my paycheck before it got deposited into my account.

In my planner, I made boxes for:

- Paycheck: How much my “Gross Pay” is (amount my work pays me BEFORE benefits/taxes/etc. are taken out)

- Taxes: All my taxes…. sob

- Benefits: Health Insurance, Dental Insurance, Transit Pass, etc.

- HSA: My per-paycheck “Health Savings Account” contribution

- 401k: My per-paycheck Roth 401k contribution

- Net Pay: My “Take Home” (amount deposited into my bank)

As I mentioned in my June Recap post, I have recently changed my contribution for my HSA, to be around $400/month (to max out the annual contribution limit) in preparation for medical bills to come. So every paycheck, I am contributing around $190 to HSA. For my 401k, I am meeting the match % by contributing around $200/paycheck. With all of my benefits, taxes, HSA, and 401K taken into account, my Take Home is about 53%.

Yay for living in NYC and our ~30% taxes….

Being Aware

This step was not completely necessary if your pay stub tells you how much your take home is. But it is interesting and beneficial to your Financial Health, to see where your money is going before you even get that deposit in your account.

If you are eligible, 401K and HSA are two areas that you can put in a little more every month with relatively little pain, and reap benefits later on in your life. Especially if you are putting in your 401K pre-tax. These are money taken out before you even see your paycheck, so it’s a bit of guaranteed saving you would be doing without any effort or temptations to spend on your part.

I have a few friends who put in money into the 401K, and treat it almost as a savings account that they can’t touch. It helps them because it’s difficult for them to resist the temptation to spend whatever is lying in their actual bank accounts. One of my friends even managed to amass almost $100,000 in her 401K before her 5th year of working! And best part is, it’s being actively invested, so you are making profit on the money you are saving in your 401K to prepare for your retirement.

HSA is pre-tax, so you get 100% of the money you put in to spend on your medical bills. However, it requires you to have a HDHP (High Deductible Health Plan), which may or may not be the best choice for you, depending on your medical conditions.

You can learn more in one of the posts I’ve written: Automating Your Way to Financial Independence.

http://twistedpaths.org/automate-finances/

Step 2: Core Living Expenses

I defined “Core Living Expenses” as “Expenses Required to Live in My Apartment and Not Have Services Turned Off” (or get kicked out).

These expenses and bills included:

- Rent: $XXX

- Wifi: $32.50

- Utilities: $30-50

They are all half the actual amount of each bill, as I live with one roommate. Since I pay all of the bills upfront, it means I do need to keep the full amount in my checking account, which is something I have to be mindful of before getting transfer-happy.

They are all half the actual amount of each bill, as I live with one roommate. Since I pay all of the bills upfront, it means I do need to keep the full amount in my checking account, which is something I have to be mindful of before getting transfer-happy.

Also, since water and heat is included in the rent, utilities varies on the season, from anywhere between $60 to $100+ for the electricity bill. Last month, our electricity was $100.82, which is definitely much higher than the mid-60’s we had during winter, when we didn’t use AC.

Just to be safe, I got the Maximum amount of Core Living Expenses I’d have for the month, which left me with about $444 for the month.

I generally like to keep my Checking Account balance fairly low so I don’t feel like I have a lot of money to splurge, or not be able to clearly see the ups and downs of my accounts.

Step 3: Other Bills

There are then “Other Bills” that are automatically taken out of my accounts, or I know for sure that I will have to pay. I don’t need them to survive or live in my apartment, but they are just things I subscribe to, or have recurring bills for on a monthly basis.

These include:

- Gym: $20/mo

- Netflix: $10/mo

- Laundry: ~$60/mo

- Yoga: ~$30/mo

In total, the “Other Bills” are around $120/month.

Taking that from $444 I had left over after taking out the Core Living Expenses from my Net Pay, I am left with around $324/month.

Step 4: Budgeting and Saving Money

Just to give myself a few dollars wiggle room in case there are unexpected spikes in the utility bills or laundry prices, I am going to say I have $320 to live on for the month of August.

Just to give myself a few dollars wiggle room in case there are unexpected spikes in the utility bills or laundry prices, I am going to say I have $320 to live on for the month of August.

To make it easier to keep track, I am going to go to the bank on July 31st and take out $320 in cash from the ATM. Then I will also take out $90 for the Laundry fee and Yoga classes that I have to pay by cash, for total of $410.

I will have to make sure to keep the 2 sets of funds separate so I don’t accidentally bleed into the “Other Bills” stash. I’ll probably keep them in separate envelopes.

Because I am not much of a buyer in the first place (unless it comes to a purse I just fell in love with or something…), most of my money will probably go to food. I think I will utilize the Envelope System to budget the money out, since Mint can’t keep track of it for me this month.

August Budget:

- Food (Groceries, Eating Out): $270

- Shopping: $50

- Total: $320

Since there are 5 weeks in August, $270 for food for the whole month means $54/week, or $8.70/day. This is going to be pretty challenging, especially in New York City! (Halal cart all day every day????)

While I know for certain that I will have a lot of medical expenses coming up in the next few months, I am hoping that my $400/mo contribution into HSA is enough to cover it. If not, I might be in a bit more of a budget pinch than I anticipated. The first $440 of my medical bills for the next month is already taken into account with my HSA contribution. If it goes over that, I’m going to have to re-evaluate.

One thing I don’t have to worry about, being a New Yorker, is my transit. I have an unlimited metro card that is automatically funded pre-tax through my paycheck, so the $121/month I spend for the card is already taken out and put into the card without having to lift a finger. This is part of my benefits, so it was already taken care of in the first step. This makes budgeting transportation a lot easier for me than having to take into account Car Insurance, Gas, and potential maintenance fees.

Step 5: The Other Paycheck

So now that the first paycheck of the month is taken account of, I have the second paycheck to think about. I have a recurring automatic transfers of $750/mo into my Investment Portfolio, and $50/mo into my Savings Account. That there takes up $800/mo of the “other paycheck” automatically.

I’ve also boxed the second paycheck out, and still trying to decide if I should put in the excess into my Savings Account, or transfer them into the Investment Portfolio, since I do have a few thousand dollar buffer in my Savings Account already.

All in all, I’m not sure if I’d be doing much more saving than I already am, because of my automatic transfers being so high already, but I’m excited to see where I will be in a month, and whether I was actually able to pay for everything on around $300 for the whole month of August.

Saving money while living in one of the most High-Costs of Living city in the world? Let’s try!

Step 5: Reflection at the End

I will be posting a reflection entry at the end of the month to let everyone know how it went, and whether I was able to save money. If any of you would like to challenge yourself as well in August, please feel free to yoink this idea, and give it a go! If you link this post, and leave your challenge link in the comments, I’ll link them in the reflection post I will make at the end of the month.

I will probably also make an update post around the middle of the month to reflect on what my budgeting is looking like mid-way (since that’s when I would have the second paycheck, which I am hopefully not going to spend).

Even if you can’t make it on half of your net income for the month, maybe you can come up with an amount you want to save for the month, and can budget around that, to see what your spending $$$ is for August.

I hope I’ll see how everyone noodled out their budgeting and managed to save money for this challenge!

- Here’s a Follow Up after my month: Living on $10.32 in NYC

Currently…

- Reading: The Life-Changing Magic of Tidying Up (Marie Kondo); The More of Less (Joshua Becker)

- Visiting: Better App

- Listening: Stress Relief by Spotify

- Health: Getting tested for Rheumatoid Arthritis to account for the Chronic Pain

Good luck with your challenge. I am sure you will manage to complete this challenge and you will save some money.

Good luck <3

Good luck. My household cannot do it due to debt and such but I envy those that can do this.

This is an interesting challenge, and I think it’s a good idea to figure out all of your finances like this! I like how you have a better idea of where your money is going now, and what each of your expenses are like. I used to categorize my spending each month to figure out where most of it went and that was enlightening.

I’m interested to hear about the results later! Good luck on the challenge!

I mentioned on Twitter (and my recent post!) but you’ve really inspired me to get back into Minimalism. I was really into it at the start of the year but sort of slipped, after reading some of your posts and seeing your tweets – it’s got me back in the mindset, so thanks, Hiro!

This is such a great challenge, I’m definitely going to try and adapt it to my own especially since I won’t be working full time starting the end of September (I return back to my studies) so would need to be on top of my money.

Keep sharing!!

Good luck with your challenge!

I’m still getting into the process of budgeting but my general rule is to take care of my bills first before deciding to spend or save any left over money.

I’ll definitely be more careful when I finish my undergrad and start fending for myself.

It’s the little steps that make all the difference! Good luck with this challenge 🙂 -Audrey | Brunch at Audrey’s

This was so informative. Thank you for sharing your tips.

Best of luck with your challenge. 🙂

Seems interesting! Not something I’ll be trying though. Good luck!