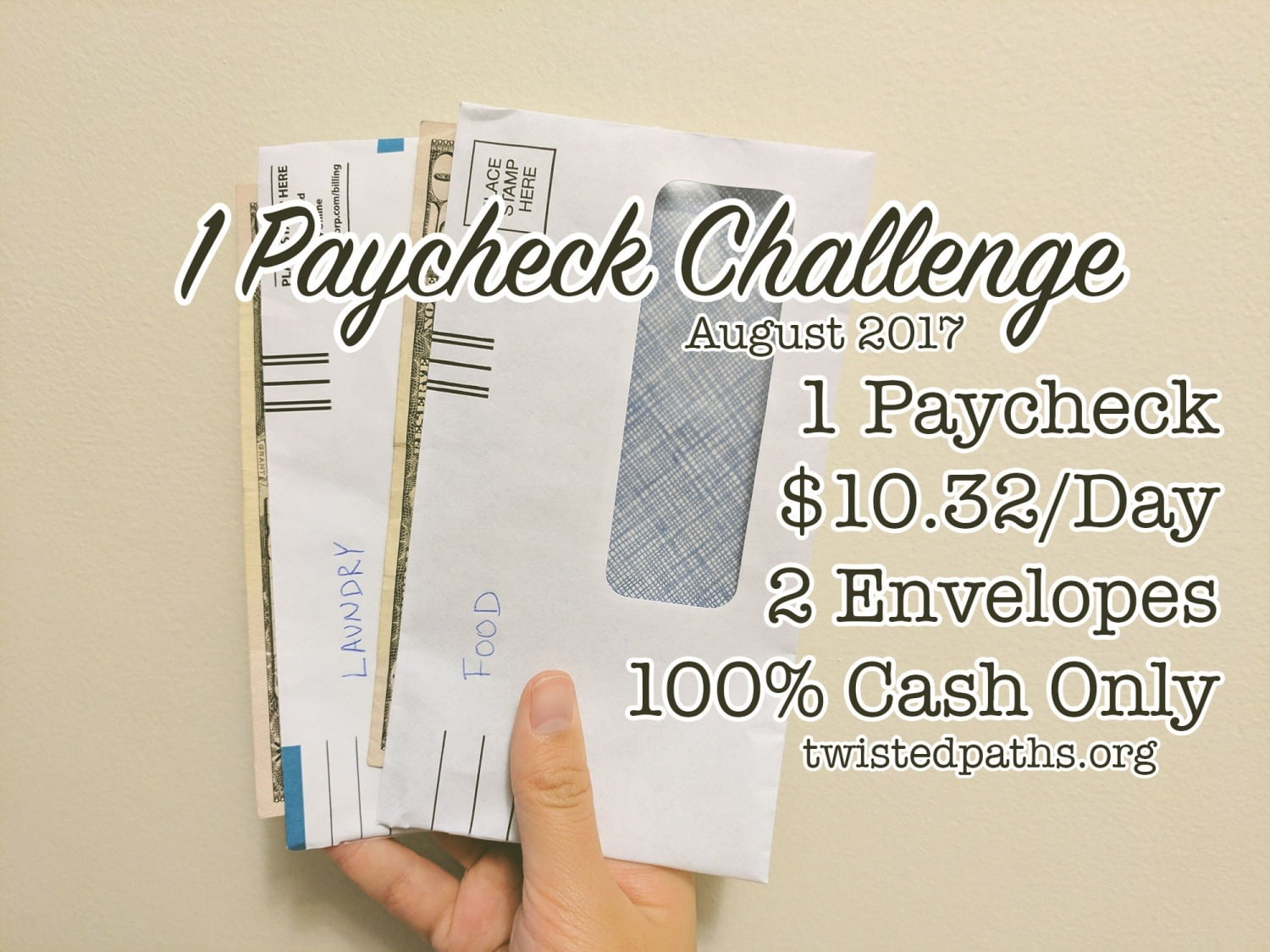

I did it guys. 31 Days. 1 Paycheck. $10.32/Day. In New York City.

Wow, my first 1 Paycheck Challenge was pretty stressful! I lived on a budget of $10.32/Day, strictly on cash so I can keep accurate tabs on what I was spending and what I had left for the month.

To recap, I started off the month with 2 envelopes:

- Fees Envelope (Yoga/Laundry): $90

- Spending Envelope (Food/Purchases): $320

My total cash for the month was $410. I came to this number after crunching how much I spend in a month with all of my concrete living costs (such as rent, wifi, Netflix, gym membership, electricity, etc.), and subtracting that from the value of my paycheck.

Before I go any further though, I just wanted to say,

thank you all so much for the outpouring of support on my last entry, both on this blog and elsewhere.

You guys helped to make this just “another thing in the life of Hiro,”

and it’s great to know that my problems that cause endless financial/physical/emotional headaches

can possibly be an avenue for educating people about chronic illnesses.

Just as I have been doing for the past 5 years with AVMs and Brain Injury,

I hope I’ll be able to spread information and resources about Rheumatoid Arthritis/Autoimmune Disorders.

If you missed it: Why I’m Taking a Chemo Drug #ButYouDon’tLookSick

Fees Envelope

There are 2 fees I pay for services on a regular basis: Yoga Classes and Laundry. I have the laundromat down the street do my laundry for me, which goes for anywhere between $10~22/load, depending on how many pounds of clothes I unload on them (yes, I’ve gone up to 25lbs of clothes…).

My Yoga Classes are $5 or $8 a session, depending on whether I take the class at work or at my local yoga studio. I guesstimated that I would spend $60 for laundry, and $30 for yoga.

In reality, I spent $24 for yoga (pretty close!), and around $45 for laundry, which adds up to around $69. I have a $20 bill left, so I guess It was +/- few dollars (I somehow misplaced my 2nd load of laundry’s price, and that was a 20+lb load, so it was probably a few more dollars than what I’ve calculated.

Fees Envelope Left Over: $20

Spending Envelope

Initially, I was going to further divide the Spending Envelope into $50 for Purchases and $270 for Food, but after a day or so, I realized that was too much categorization. There was no point in further dividing, because most of my money was spent on food every month anyways, and I inherently don’t purchase too many things.

Initially, I was going to further divide the Spending Envelope into $50 for Purchases and $270 for Food, but after a day or so, I realized that was too much categorization. There was no point in further dividing, because most of my money was spent on food every month anyways, and I inherently don’t purchase too many things.

So if I happened to want to buy something, I’ll just budget it out with the whole of “Spending Budget,” rather than have a separate budget for it.

Living on $10.32 a day in New York City was a stressful idea. In most areas of the US, I think $10 might be plenty of money to get yourself fed. But here, there’s really nothing you can get for under $10 as a meal, unless you order at a Halal Cart.

To prepare for a night out or a planned lunch with a coworker, I had to plan in advance, and “save up” the $10 from previous few days so I can pay for the food. And with all my medical stresses, sometimes I was inclined to #TreatMyself.

Otherwise, I ate whatever the office had, or brought lunch, and ate through some of my stock food for dinner. It’s really a good way to start using up some of the stock food that might be getting a little older, and need to be consumed. Also, my Decluttering Journey was actually pretty helpful, because I “unearthed” some food stuff that were hiding in places/out of sight, which I was able to eat instead of having to buy duplicates.

I did cheat once, because my boyfriend brought me some groceries (like milk), which I’m still drinking now, and fed me. My old roommate also sent me a huge amount of ginger-related-stuff, so I’m drinking ginger in warm water every day (to help with inflammation, hopefully).

Still, I managed to end up with a surplus of $105.61 out of $320 at the end of the month. Which means I spent around $215 for food and purchases for the whole month of August.

I guess you can survive pretty well on a tight budget in New York!

I kept a record of every spending in my journal.

Spending Envelope Left Over: $105.61

https://twitter.com/nishimurahiroko/status/899729994842341376

Other Cash Flow

I get paid on the 15th and the last day of the month, so as of August 30th (when this screenshot was taken), the direct deposit had not hit my account yet. My goal was for the Cash Flow (Earned – Spent) to be $0 at the end of August, because I’d have spent only as much as I earned this month.

The money that left my account accounted for stuff that come directly out of my bank/credit card (such as my Netflix and gym subscriptions, as well as my utility bills), and includes my rent. This value also includes the $410 in cash I withdrew from the ATM at the beginning of the month to use as my spending/fees money.

According to Mint, my Cash Flow for August was -$779.

Wait… Did I over spent by $779? Nope!

On the 15th of every month (to coincide with my 1st paycheck of the month), $50 goes out to my Savings Account, and $750 goes out to my Investment Portfolio. These “savings” would have been part of my 2nd paycheck for this month, as I was planning on living on just my 1st paycheck.

If I take into account the $800 that went into my savings/investments, I am actually at around +$21 from the paycheck.

So, Did You Suffer?

Stress wise, yes. It was pretty stressful, because I was bound by the numbers. And having restrictions make things really stressful for me.

But in actuality, not really. I went out a dozen times for dinner or lunch, whether with friends, coworkers, or just even getting myself a halal cart dinner or that horrible Chinese food take out (2 whole meals because I was really craving both noodles and the veggie dish).

My best friend came over to visit for a weekend, so we ate out a lot, and indulged ourselves in bubble tea as well. I honestly feel like I stressed out about this a lot more than I had to, and had made it needlessly difficult for myself. I only purchased one thing (a $4 pill case for my ever-growing number of pills I take daily), and the rest of the money was spent on food.

I set myself a budget of $320, and ended up with a surplus of $105.61. That’s another few decent meals I could’ve had, if I wanted to just break even!

AND with the $21 I had left over from the paycheck after I’d taken out all of my expenses, along with the $20 left over from my laundry and yoga budget, I could have spent another $146.61 to break even with my paycheck.

To put that into perspective, that’s almost 70% of all the money I spent all last month on food and purchases.

There was absolutely no reason for me to stress out at all!

Budgeting on Mint

So generally, I rely on my budget app, Mint. I have a pretty nitty-gritty budget on there, which includes everything from “Coffee Shops,” “Groceries,” “Restaurants,” “Gym,” “Sports,” “Public Transportation,” “Financial,” “Laundry,” “Shopping,” and “Rent.”

Something I am thinking about, after this month-long challenge, is that perhaps I should simplify it a bit, especially in terms of Food related things. Do I really need to break apart that I will spend $10 for Coffee Shops, $120 for Groceries, and $200 for Restaurants every month? Why not just have a general budget of $330 for all foods?

While I’m talking about Minimalism, I might seriously take a look at Minimalizing my Budget too.

Will You be Continuing the Challenge?

No, probably not. I might do it once every few months, though, just as a “Detox.” However, after crunching my numbers, it seems as though I already do save almost a paycheck every month (whether it be keeping it in my checking account, putting into savings, or transferring to my investment portfolio), so I might just be sustainable at a perpetual #1PaycheckChallenge mode (but minus the stress!).

No, probably not. I might do it once every few months, though, just as a “Detox.” However, after crunching my numbers, it seems as though I already do save almost a paycheck every month (whether it be keeping it in my checking account, putting into savings, or transferring to my investment portfolio), so I might just be sustainable at a perpetual #1PaycheckChallenge mode (but minus the stress!).

Another thing that made me very nervous in August was the climbing cost of medical bills in the past few months, because of my Chronic Pain and diagnosis of Rheumatoid Arthritis (I just made a blog post about it last week).

Between June, July, and August, I have spent enough money on my medical bills to have reached my deductible in my HDHP (High Deductible Health Plan). From now on, until I reach $3500 out of pocket for this year, I’ll be paying for 20% of the bill, instead of 100%.

Thankfully, at this point, I have not overshot my HSA balance. However, I am anticipating overshooting by hundreds of dollars in September, as I have an outstanding medical bill of $800 (from my first rheumatologist appointment), and will be seeing the rheumatologist again today as well as my primary care doctor next week (at which point she will be doing more specialized tests to see if I may have Ehlers Danlos Syndrome).

Because the system does not allow me to “front load” my HSA account (aka: dump all the money into the HSA now, as opposed to $200/paycheck up to end of December), I am going to have to spend money from my actual bank account, and reimburse myself later.

Where’s the $$$?

So what did I spend the surplus from last month’s budgeting on? A haircut!

https://twitter.com/nishimurahiroko/status/904072726738067458

It was the first haircut I had since moving to NYC 3 years ago in the city (I always just went back home and went to the same hairstylist I’ve had since elementary school), so it was pretty stressful and expensive, but I’m glad I finally did it. I’ve been wanting to chop my hair off for years, but never had the courage to do it, because as straight as my hair looks, it’s pretty finicky.

I’m hoping that it’ll lessen the speed at which I’m losing hair from the chemo drug (and I’m just naturally inclined to lose a lot of hair every day), because it’s lighter, and it’s not pulling as much on my follicles.

Now I have to style it every time I wash it, and worry about how it’s flipping (my hair has bad tendency to flip in weird ways), but it takes so much less work to wash it, and it doesn’t get in the way like it used to. The bangs are annoying, but I think I’ll figure out how to manage them soon.

I’m not sure what I’ll do with the “extra” I have in my bank from the other pay check (that didn’t go into my savings or investment portfolio automatically), but I have a vague feeling it’s going to be needed soon for my upcoming medical fees.

https://twitter.com/nishimurahiroko/status/904446213885452292

So, did you partake in the #1PaycheckChallenge, or any iterations of it? What did you think?

If not, do you think you’d try something, even if it’s for a week or just a few weeks?

Do you have any Challenge you think I should try next?

Awesome!!! I had no doubts that you could do it! You’re truly inspiring.

Thank you! I’m so glad it’s over. LOL. No joke. XD

Wow o.O

You did really well. I’d love to try to do something like this, but dear Lord my husband would die I think lol

He is one of those people that gives in to late night food cravings, and the only thing open that late in this tiny little town is Pilot/Flying J Truck Stop soooo you can imagine how expensive it is!

I need to start a savings and start forking over money into it, and just having it accumulate so we actually have a savings! Right now I barely have 20 bucks left over(some months IF that) by next pay day, and that does not please me in the slightest lol

I think you did a GREAT job!

Thank youuu! It’s not so bad! I promise! Lol. You could even set him up a specific budget for that craving… He has to make his cravings happen within that $100 budget. LOL. Besides, it’s healthier to not indulge ourselves too much in our cravings… XD

And yeah; I see a lot of my friends struggling with having money right before pay day, and that just seems like a very very stressful way to be! I’d recommend even saving $5/week (transferring to savings account), or transferring $20 every paycheck immediately or something like that… Little stuff really do add up!

Congratulations on doing this challenge. It’s not something I would be able to do myself, but I do try and save as much as I can. It’s good you were able to see just how much you do save outside of the challenge! That’s a nice haircut and it’s good to splurge every once in a while.

I feel like any saving is good saving. Some people don’t save at all and that is one of those things that will definitely come bite them in the butts some day 🙁 It’s always so scary reading posts my friends make about not having money… I can’t live with the stress. x_x

And thank you so much! Yeah; I’m hoping I won’t have to do it too often, but hey… I don’t buy stuff much, maybe it’s ok to spend some money on myself once in a while! 🙂

I’m so proud that you did it though, I was curious to see how it would turn out and have enjoyed following updates! (I think that’s what I love most about your blog, how you really challenge yourself and stick to it, it’s so admirable!)

Spending $105 out of $320 is incredible. ESPECIALLY IN NEW YORK CITY. Girl, I was there for 10 days and spent probably like $500 on food. Well done! I need to get my butt back there so you can take me to all the cheap places and learn from to save in the big city from the best 😉

I am SO IN LOVE WITH THIS HAIRCUT OK OK I CAN’T You’re so beautiful, it suits you SO much!

I was totally proud of myself for going through all that stress. LOL. It’s kind of weird because since I don’t really have a good perception of money, I ended up with a lot of surplus (I mean, good thing, but at the same time, not worth the anxiety LOL).

I can’t wait for you to come back so I can drag you around to all the foods. I should probably start creating a post with all my favorite cheap eats… AN EXCUSE TO GO TO ALL OF THEM AND TAKE PHOTOS??

And thank youuuuuuuuu it was sooo nerve wracking but I’m so glad I finally did it! I’ve been wanting to SLICE HAIR OFF for YEARS!

Ohhhhhh I LOVE THIS IDEA! I actually haven’t heard of this challenge previously, but now that I’ve read your post, I’m DEFINITELY going to do it! I find myself spending a LOT of money on food, so I think that pulling out a set amount for the month in cash would help me control that. I’m actually excited to challenge myself haha.

Ps. Your hair looks amazing!

I highly recommend it. It’s fun (in a weird, stressful way), and it’s really rewarding at the end, because you know you’ve just accomplished something most people immediately recoil and go, “Oh no way!” on. Please come by and let us know if you make a post about it; I’d love to come check it out! 🙂 And it’s kind of liberating in a way because you have all this cash, and how you use it is completely up to you. And very easy to keep track of how much you have left. So many of my friends/coworkers were very surprised that I was trying such a thing.

And thank you! I haven’t cut it this short EVER, so it was really nerve wracking, but I’m so glad I did it! 🙂

Congrats on completing the challenge! I’m amazed that you were able to go $10.32/day in NYC. That’s awesome that you made it work! I really like how organized you were with the challenge, though I can see how that’s stressful to keep a number in mind each day. That’s nice that you were still able to eat out with friends with this budget. Good job on ending up with a surplus!

I already said this on Twitter, but I really like that haircut! It looks so good on you!

Thank you!! It was a lot stressful than it needed to be, and I think now that I did it once, I have a better “grasp” on how to manage my anxiety and money better so I don’t end up with a surplus, and can do it more comfortably. Definitely won’t be something I’ll be partaking in too often though… XD I’m looking for my next financial challenge to do though. Maybe alternating weeks on eating 100% in, and the next week not…. Or something like that. And I think I’m kind of rebounding this month. LOL. I guess I’ll see how my credit card bills look at the end of the month. XD

Wow!! Congrats on completing the challenge successfully. I find budgeting reeeaaaaally hard, so I think it’s super amazing you managed to do it in a city like NYC!

I like how you planned ahead in cases you had to spend more than $10.32 per day. And how you tracked your finances. Also super smart!

I attended a class once and they talked about budgeting and how they took their debit/credit card out of their wallets and only carried around a specific amount of cash around with them each day. I was so amazed hearing that. I can’t even imagine doing that! But I think it’s cool to try so you know where your money goes and you don’t go over.

I like your new haircut! It looks super good on you!

Thank you! I definitely don’t think I can manage without having a Credit Card in some capacity, because I want to be prepared for emergencies. But I don’t really use it that often in general (except when I’m getting food), so it doesn’t really cause issues for me to have it (it’s more like carrying around my insurance cards; just in case). But living on cash I think is a great way to go, especially when you’re starting out with budgeting. There’s been studies that show that when you are using card, your brain doesn’t react the same way it does with cash, because you pass over something, and then it comes back to you (the card), so to your brain, you basically got this nice thing for nothing. When you use cash, you give a certain amount, and then only little bit comes back, so your brain reacts with pain reaction, which lets you know “oh I’m spending money and it’s a sad thing because now I have less.” I’m still on the fence about how I want to keep on going, but for now, I’m back to my credit card + Mint monitoring life. XD

That sounds like a really interesting challenge and a great way to save money! Like you, I hate having to stick to a small amount, and love having the freedom to buy what I want, so I bet I’d find that really hard. I’m sure it’d get much easier once you got into it though.

I’m trying to save money next month because I spent too much on holiday. Hopefully I won’t end up going to any events because I just can’t help myself when I’m out!

Love the new haircut.

I highly recommend it, if you’re willing to put in a whole month of math and keeping track. If not, something like just saving $20/week or something goes a long way too. Good luck on recouping the spending from the holiday!! (But you know, you gotta treat yourself on a holiday… 😉 )

Gosh, what an interesting challenge – and well done for coming out on top! It sounds like it would have been tough – having to live to such a precise number. It’s certaintly not something I could so continously, but I would definitely like to try a few times a month as a ‘detox’ – like you suggested!

I’m sorry to hear about your medical costs, though. I hope it isn’t causing you too much stress.

Your haircut it so nice, it really suits you!

Thank you! I highly recommend doing periodic detoxes! Maybe before months you know have higher expenses than others so you are able to put more into those months 😀 Or maybe you want to take a trip in a few months’ time. Having a WHOLE PAYCHECK saved up is pretty rad, I think. Good luck, and thanks for the compliments!!! 🙂

Congrats on the challenge! This is all so interesting. My spending has gone through the roof lately, and I’ve been contemplating printing out last month’s bank statements and actually dividing out what exactly I’m paying each month (and wasting money on, and services in auto-pay that I might be able to cancel completely). My boyfriend and I are trying to save for a house, so partaking in your challenge as well could definitely benefit us!

Your haircut is so cute, too 😀

That’s always a good way to assess! I like Mint because it kind of does most of the number crunching for me, and I just kind of have to review it to see what went where. Saving up for a house is a big task! Good luck. 😀 It’s always great to have a concrete goal!

Love your new haircut! It’s cute.

Congrats on making it thru the paycheck challenge. I’ve been doing mealpal for the last 2 months which helps me save $$ on lunch but sometimes I just want Chipotle lol.

I had a little incident last week that made me think of you. My dog bit my index finger really deep and it got swollen. It hurt a lot and I could not bend my finger for a week. I know it’s not the same as in your situation with RA but it definitely made me understand how hard it is to do stuff when one finger is out of commission!